Have you ever wondered what happens behind the scenes when you click "pay" on a website, especially when buying from a company halfway across the world? While the transaction feels instant to you, there's actually a complex global relay race happening underneath involving banks, processors, foreign exchange conversions, and compliance checks.

The Traditional Payment Stack: A Complex Maze

When you make a payment online, you're initiating a journey that involves multiple players. Let's break down the traditional payment stack to understand why global payments are so complex.

The Domestic Payment Flow

- Checkout Interface & Payment Gateway: The secure digital courier that encrypts your card details and passes them along

- Payment Processor & Card Networks: Companies like Visa or Mastercard that facilitate the communication between banks

- Issuing Bank: Your bank that verifies you have sufficient funds and approves the transaction

- Acquiring Bank: The business's bank that temporarily holds your payment in a merchant account

- Settlement: The final transfer of funds from the merchant account to the business's bank account

This process is already complex for domestic transactions, but when payments cross borders, the complexity multiplies exponentially.

The International Payment Complications

International transactions introduce several additional layers of complexity:

- Higher processing fees from card networks for cross-border transactions

- Multiple banks including intermediary banks handling currency movement

- Foreign exchange (FX) conversions that often come with hidden markups

- Compliance checks for anti-money laundering and international fund flow restrictions

- Different settlement timeframes that can delay access to funds

Consider this scenario: You're a UK-based business with a customer in the US. The customer pays in USD, but your account is in GBP. Your bank automatically converts the currency with their markup. Later, when you pay a US supplier in USD, you convert back again - resulting in double FX fees that can cost you 3-4% of the payment value.

Now imagine scaling this across 10+ countries with different currencies, banks, and compliance rules. The legacy global payments stack becomes slow, expensive, and inefficient for businesses operating globally from day one.

The Modern Approach to Global Payments

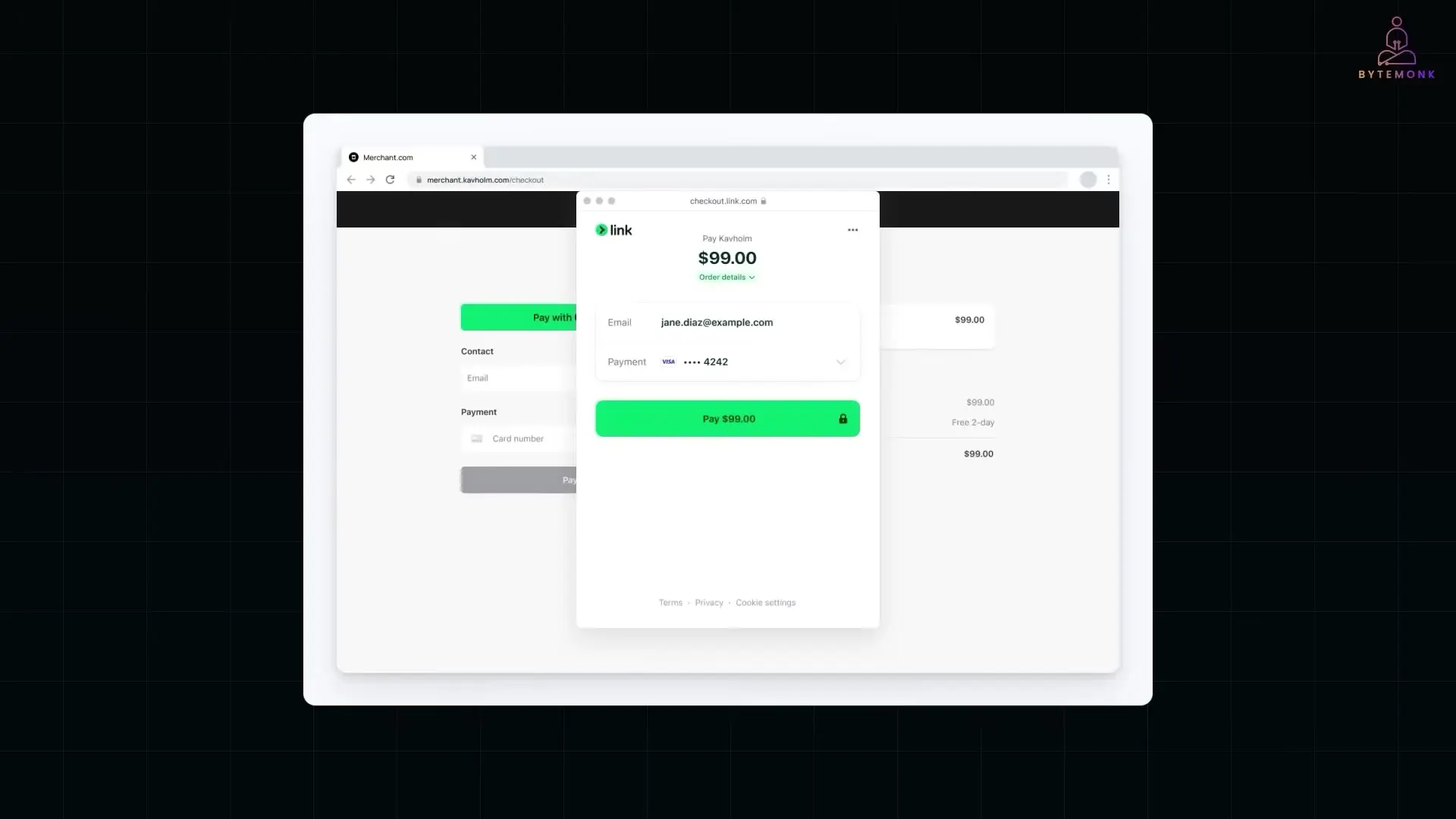

Modern payment platforms are changing how global payments work by consolidating the fragmented legacy system into a unified solution. Instead of juggling different banks, currency converters, payment gateways, and processors, businesses can access a single platform that handles everything through one API.

Key Features of Modern Global Payment Platforms

- Support for 160+ local payment methods beyond just credit cards (digital wallets, instant bank transfers, buy-now-pay-later options)

- Multi-currency accounts that allow businesses to hold funds in 20+ currencies without forced conversion

- Like-for-like settlement that eliminates unnecessary currency conversions

- Near-market exchange rates without the usual markup when conversion is needed

- Direct connections to local banking networks in 150+ countries for faster, cheaper payouts

- Same-day settlement for 95% of transactions

- Savings of up to 80% on FX fees through smart routing and conversion strategies

The Developer Perspective: API-First Architecture

Modern payment platforms are built with developers in mind, featuring API-first architecture that allows for programmatic control over the entire payment ecosystem. This means developers can:

- Programmatically accept payments across multiple methods and regions

- Trigger FX conversions when rates are favorable

- Embed local payment methods into checkout flows

- Issue virtual cards for business expenses

- Test payment flows end-to-end in a developer sandbox

- Access detailed documentation and SDKs in multiple programming languages

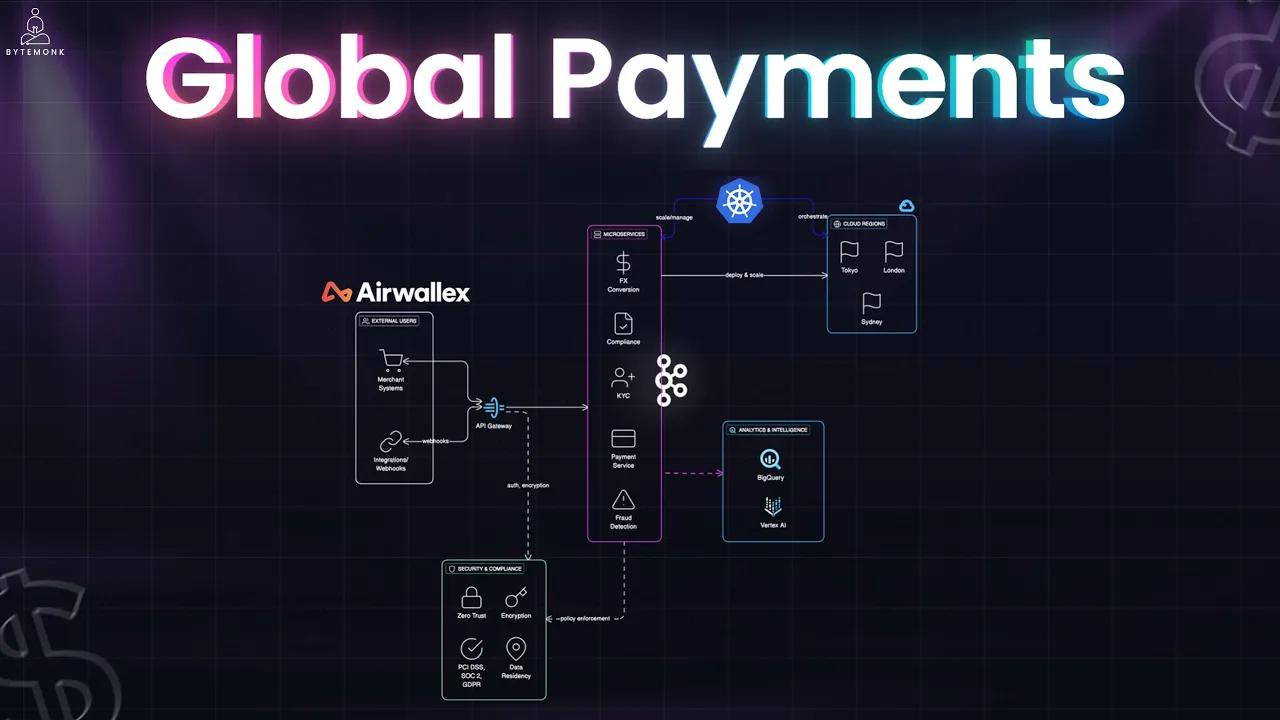

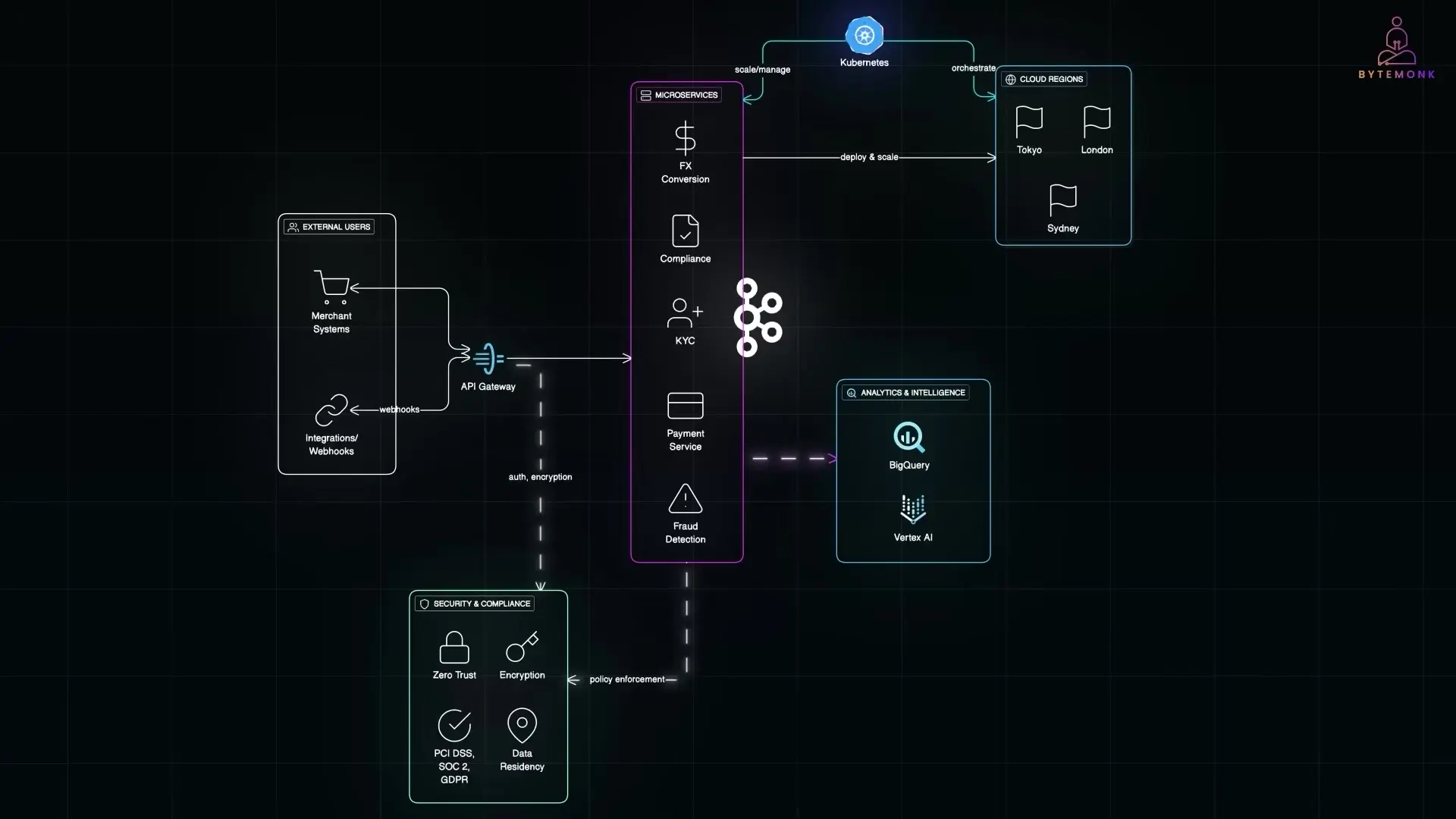

The Technical Architecture Behind Modern Global Payments

To deliver flexibility and scale across global markets, modern payment platforms employ sophisticated technical architecture:

Microservices Architecture

Instead of monolithic systems, payments platforms use microservices architecture where each component (payments, FX conversion, compliance checks, fraud detection) operates as an independent service. These services communicate through event streaming platforms like Kafka, enabling real-time data flows between components.

// Example of a payment processing event in Kafka

{

"transaction_id": "tx_12345abcde",

"amount": 100.00,

"currency": "USD",

"source_currency": "EUR",

"payment_method": "card",

"country": "US",

"timestamp": "2023-04-15T14:22:31Z",

"status": "processing"

}Cloud Infrastructure & Global Distribution

Modern payment platforms typically run on cloud infrastructure (like Google Cloud) across multiple regions. Payments get routed to the closest region (Tokyo, London, Sydney, etc.), keeping latency low and performance high. Kubernetes orchestrates the containerized services, allowing automatic scaling during traffic spikes from thousands to tens of thousands of transactions per second.

Security & Compliance

Security is paramount in payment processing. Modern platforms implement:

- Zero-trust security environments

- End-to-end encryption for all data

- Tightly controlled access protocols

- Compliance with industry standards (PCI DSS, SOC 2, GDPR)

- Intelligent routing to keep data local (e.g., EU transactions stay on EU servers)

- Advanced fraud detection using AI and machine learning

Intelligent Data Processing

Modern payment platforms leverage data analytics and AI to optimize operations by:

- Analyzing millions of transactions to detect fraud patterns

- Optimizing payment routes for speed and cost efficiency

- Forecasting liquidity needs across currencies

- Identifying the most cost-effective settlement paths

- Continuously improving conversion rates at checkout

Benefits for Different Stakeholders

Modern global payment infrastructure provides significant advantages for all parties involved:

For Developers

- Clean, well-documented APIs reduce integration complexity

- Unified interface eliminates the need to manage multiple payment providers

- Comprehensive testing environments speed up development

- Programmatic control over the entire payment lifecycle

- Reduced maintenance overhead with fewer integration points

For Finance Teams

- Reduced manual reconciliation work

- Better visibility into global cash flow

- Significant savings on FX fees and payment processing costs

- Faster access to funds with same-day settlement

- Simplified reporting across multiple currencies and regions

For Customers

- Faster, smoother payment experiences

- Ability to pay in their preferred local payment methods

- Transparent pricing in their local currency

- Reduced payment failures

- Better overall shopping experience

Conclusion: The Future of Global Payments

The legacy global payment stack was never designed for the internet economy. It's slow, fragmented, and full of hidden costs. Modern payment infrastructure changes that paradigm by providing a unified platform with API-first design, multi-currency support, and intelligent routing.

For businesses looking to expand globally, the benefits are clear: lower transaction costs, faster access to funds, simplified operations, and better customer experiences. You no longer need multiple tools and bank accounts to operate internationally - you can build once and scale wherever your customers are.

As global commerce continues to grow, the companies that embrace modern payment infrastructure will have a significant competitive advantage in terms of both operational efficiency and customer satisfaction. The future of global payments is unified, programmable, and designed for a borderless digital economy.

Let's Watch!

How Global Payments Actually Work: The Hidden Costs Behind Cross-Border Transactions

Ready to enhance your neural network?

Access our quantum knowledge cores and upgrade your programming abilities.

Initialize Training Sequence