The artificial intelligence landscape is evolving at breakneck speed with major tech players making strategic moves that will define the future of AI. From hardware innovations to new model capabilities, recent developments signal a significant shift in how AI will be integrated into our devices and workflows. Let's examine the five most significant AI breakthroughs that are reshaping the technology landscape.

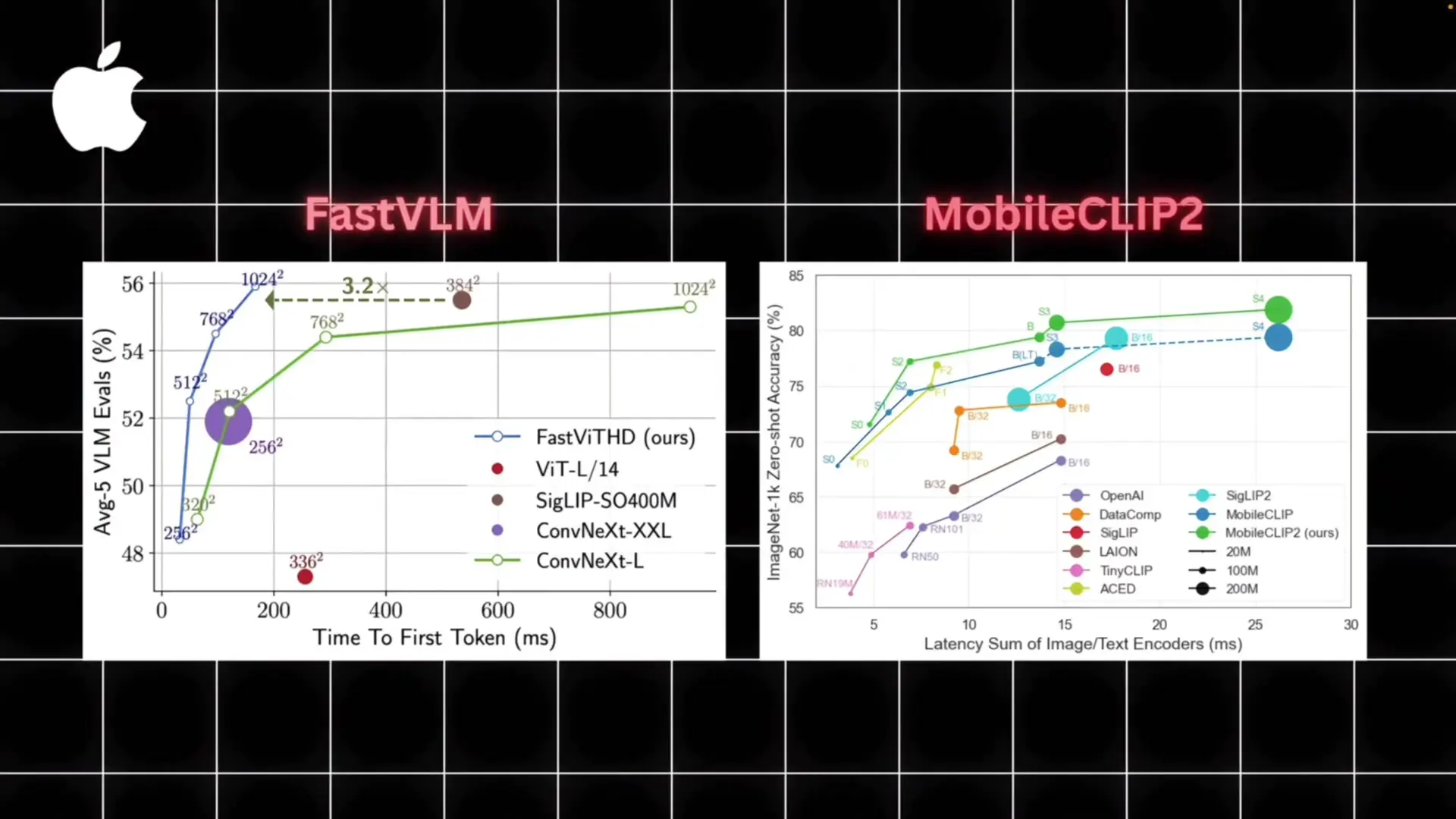

Apple's On-Device AI Revolution: Fast VLM and Mobile CLIP 2

Apple has finally revealed its AI research direction by releasing two powerful on-device AI models on Hugging Face: Fast VLM and Mobile CLIP 2. These models represent Apple's commitment to privacy-first AI processing that happens directly on your device rather than in the cloud.

Fast VLM is a 7 billion parameter vision language model designed for speed and efficiency. According to Apple's benchmarks, it runs up to five times faster than competing VLMs while maintaining high accuracy on tasks like image captioning and object recognition. This performance breakthrough enables real-time applications like video captioning directly on iPhones without cloud dependence.

Mobile CLIP 2 builds on Apple's previous work, focusing on lightweight multimodal understanding. The model efficiently matches text and images even on smaller devices, with multiple size options available to developers who can choose between maximum speed or accuracy based on their specific use case requirements.

Apple's strategy centers on two key advantages: privacy and performance. By processing AI locally, user data stays on the device, aligning with Apple's privacy-focused brand identity. Additionally, on-device processing eliminates cloud latency, providing instant AI responses. This approach sets the foundation for next-generation iPhone experiences that remain intelligent even without network connectivity.

OpenAI's Strategic Chip Partnership with Broadcom

In a move that could reshape the AI hardware landscape, OpenAI is partnering with Broadcom to mass-produce custom AI chips starting in 2026. This strategic decision addresses several challenges the company currently faces with its heavy reliance on Nvidia's GPUs for model training and inference.

- Cost reduction for training massive models like GPT-5

- Greater control over compute supply chain

- Ability to optimize chips specifically for OpenAI's unique workloads

- Enhanced capabilities for long context reasoning and agentic behaviors

This development follows an industry-wide trend of tech giants developing proprietary AI silicon. Google has its Tensor Processing Units (TPUs), Amazon has Trainium, and now OpenAI is joining the custom chip race. If successful, this partnership could begin to challenge Nvidia's current dominance in AI hardware and potentially accelerate OpenAI's development cycles for future models.

Amazon Enters the AI Agent Race with Quick Suite

Amazon is making a significant push into the AI agent space with its new offering called Quick Suite. According to internal documents obtained by Business Insider, Quick Suite combines Amazon's existing tools like QuickSight for analytics dashboards and Q Business for conversational insights, enhanced with AI agents that can autonomously pull data, perform analysis, and generate recommendations.

Think of Quick Suite as providing every business user with a personal AI consultant. Amazon has already rolled this out in private preview to over 50 major enterprises including BMW and Intuit. The value proposition is clear: instead of spending hours manually analyzing data, Quick Suite's agents can surface insights and automate actions instantly.

This move represents a strategic shift for Amazon. While AWS dominates cloud infrastructure, Microsoft and Google have traditionally held the advantage in enterprise software with products like Office/Copilot and Workspace/Gemini. Quick Suite positions Amazon to compete directly in this space, targeting the estimated 40% of business users expected to adopt AI-enhanced workflows in the near future.

Early tester feedback has been mixed - while users praise Quick Suite's simplicity and AWS data integration, questions remain about permissions, governance, and agent flexibility compared to more established offerings. Nevertheless, this positions Amazon in direct competition with Microsoft, Google, and even OpenAI in the enterprise AI space.

DeepSeek's Next-Generation Agent Model

Chinese AI company DeepSeek, which gained attention earlier this year with its R1 model, is preparing to release a new agent-capable model by the end of 2025. This announcement signals DeepSeek's ambition to compete with industry leaders like OpenAI and Anthropic in the next frontier of AI development.

Agent capabilities represent a significant evolution beyond traditional chatbots. These advanced AI systems can plan, reason, and execute multi-step tasks with minimal human supervision. If DeepSeek delivers on its promises, it could establish itself as a serious global competitor, particularly with China's strategic push to develop domestic AI champions.

Anthropic's Claude Opus 4.1 and Strategic Expansion

Anthropic quietly released Claude Opus 4.1 in early August as a drop-in upgrade to Opus 4. The improved model offers faster processing, enhanced reasoning capabilities, and better handling of complex workflows. On the SWE coding benchmark, it achieved 74.5% accuracy (up from 72.5%) - a seemingly small improvement that translates to significant real-world advantages in multifile refactoring and long-horizon reasoning.

A notable feature allows developers to adjust the model's "thinking budget" via API, choosing between quick responses or more deliberate step-by-step reasoning based on task requirements. However, the technical upgrade is just one part of Anthropic's broader strategic moves.

- Secured a $13 billion Series F funding round, pushing valuation to $183 billion (nearly triple its value from earlier this year)

- Implemented new safety features allowing Claude to end conversations if it detects harmful or abusive interactions

- Announced restrictions blocking access to Claude for firms majority-owned by Chinese companies like Tencent or Alibaba, citing legal and security risks

These developments position Claude Opus 4.1 as the centerpiece of Anthropic's enterprise strategy, backed by record funding and aligned with US policy priorities. While the Chinese market restrictions may cost Anthropic millions in revenue, they demonstrate the company's commitment to building trust with Western enterprise customers and government partners.

The Shifting AI Landscape: What It Means for the Future

These five major developments reveal clear battle lines forming in the AI industry around three critical questions: Who controls the chips? Who builds the platforms? And who earns the trust of businesses worldwide?

Apple's on-device AI strategy emphasizes privacy and performance, potentially changing how consumers interact with AI in daily life. OpenAI's chip partnership with Broadcom signals a move toward vertical integration and reduced dependence on Nvidia. Amazon's Quick Suite represents an aggressive push into enterprise AI software, challenging Microsoft and Google's traditional dominance. DeepSeek's agent model development highlights the global competition in advanced AI capabilities. And Anthropic's comprehensive strategy combines technical innovation with business and geopolitical positioning.

For developers, businesses, and consumers, these shifts mean more options but also more complexity in the AI ecosystem. The race for custom AI chips, on-device processing, agent capabilities, and enterprise integration is accelerating, with significant implications for how AI will be developed, deployed, and regulated in the coming years.

Let's Watch!

5 Major AI Breakthroughs: OpenAI's Custom Chip Strategy Reshapes Tech Landscape

Ready to enhance your neural network?

Access our quantum knowledge cores and upgrade your programming abilities.

Initialize Training Sequence